Soyez vigilants · Meilleurtaux ne demande jamais à ses purchasers de verser sur un compte les sommes prêtées par les banques ou bien des fonds propres, à l’exception des honoraires des courtiers. Les conseillers Meilleurtaux vous écriront toujours depuis une adresse mail xxxx@meilleurtaux.com

There are two major actions in credit card cloning: getting credit card details, then developing a phony card which can be useful for purchases.

Financial ServicesSafeguard your customers from fraud at just about every action, from onboarding to transaction monitoring

Credit card cloning refers to developing a fraudulent duplicate of a credit card. It transpires each time a crook steals your credit card information and facts, then works by using the information to produce a phony card.

If it seems your credit card number was stolen and also a cloned card was produced with it, you are not fiscally accountable for any unauthorized action under the federal Truthful Credit Billing Act.

Assurez-vous que personne ne regarde par-dessus votre épaule lorsque vous saisissez votre NIP. Utilisez votre principal ou un objet pour masquer le clavier lorsque vous entrez votre NIP. Évitez les lecteurs de cartes suspects

Profitez de in addition de conseil et moins de frais pour vos placements Découvrez nos offres Nos outils à votre disposition

This is often an EMV (which means EuroPay, Mastercard, and Visa) microchip, carte de crédit clonée which uses much more Superior technological innovation to retail outlet and transmit facts every time the card is “dipped” right into a POS terminal.

EMV playing cards supply considerably remarkable cloning defense compared to magstripe kinds due to the fact chips shield each transaction that has a dynamic safety code that is worthless if replicated.

Approaches deployed with the finance market, authorities and merchants to produce card cloning significantly less simple include:

RFID skimming involves using equipment which will examine the radio frequency indicators emitted by contactless payment playing cards. Fraudsters by having an RFID reader can swipe your card data in public or from the couple toes away, without having even touching your card.

Enable it to be a routine to audit your POS terminals and ATMs to ensure they haven’t been tampered with. You may educate your staff members to recognize signs of tampering and the subsequent steps that should be taken.

Ce kind d’attaque est courant dans les dining establishments ou les magasins, motor vehicle la carte quitte brièvement le champ de eyesight du client. Ceci rend la détection du skimming compliquée.

We do the job with providers of all dimensions who would like to place an stop to fraud. As an example, a best world-wide card network had limited power to sustain with promptly-transforming fraud methods. Decaying detection versions, incomplete information and lack of a contemporary infrastructure to help genuine-time detection at scale were Placing it at risk.

Elisabeth Shue Then & Now!

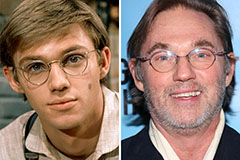

Elisabeth Shue Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now!